On why we should listen to old, beardy revolutionaries

The bonus culture that's emerged in the last thirty years is offensive, as well as being a primary contributor to the growing inequality in our societies. It has contributed directly to the current financial crisis in two ways. First, in some instances, the scale of bonuses have meant that the losses being posted by major institutions would have been substantially removed, if not eliminated entirely, were they not paid out. In this sense they amount to little more than theft, since the point of a bonus is to reward performance, not produce failure. Second, by linking bonuses and options to short-term movements in share prices, they also indirectly encouraged individuals to take excessive risks, which produced the bubbles that popped in our faces this past year or so.

The bonus culture that's emerged in the last thirty years is offensive, as well as being a primary contributor to the growing inequality in our societies. It has contributed directly to the current financial crisis in two ways. First, in some instances, the scale of bonuses have meant that the losses being posted by major institutions would have been substantially removed, if not eliminated entirely, were they not paid out. In this sense they amount to little more than theft, since the point of a bonus is to reward performance, not produce failure. Second, by linking bonuses and options to short-term movements in share prices, they also indirectly encouraged individuals to take excessive risks, which produced the bubbles that popped in our faces this past year or so.So far nothing surprising. Ridiculous bonuses are proving both damaging to society and damaging to the economy. But this is, unfortunately, about as far as the argument goes before things start getting complicated.

One: who is to say what is a reasonable salary for a private sector job if we don't trust the market to do it? If we impose more restrictive bonus offerings across the board, then businesses will simply raise salaries instead. Some of us in this world are willing to get paid less because we believe our jobs have a social value to them. But most people aren’t so lucky: they do stuff they’d rather not do because it gives them the money to live. This current crisis may have been fuelled by greed, but – I’m sorry – that’s capitalism. Most jobs aren’t rewarding enough that people would do them for free. And if you were offered twice your salary to do the same job in the office two blocks along, would you really say no?

Two: what can we do to stop this problem? Yes, we can probably fix bonuses in state-owned or state-controlled banks, and fix them a lot lower than this $500,000 number that Obama has mentioned. Given that no banker in the current market is likely to quit their job in the expectation of finding a new one, we might even have a decent impact as a result. But if things return to the status quo ante when the economy picks up again, the only lesson bankers will learn is that it pays to get stock options turned into cash offshore even more quickly than they have done in the past. Without meaningful structural changes, bankers will, entirely rationally, conclude that a periodic dressing down in front of senators (relieved no doubt afterwards with a martini in a personal limousine taking them to the spa at the weekend country mansion) is a price worth paying for $300 million a year. I’d take that deal!

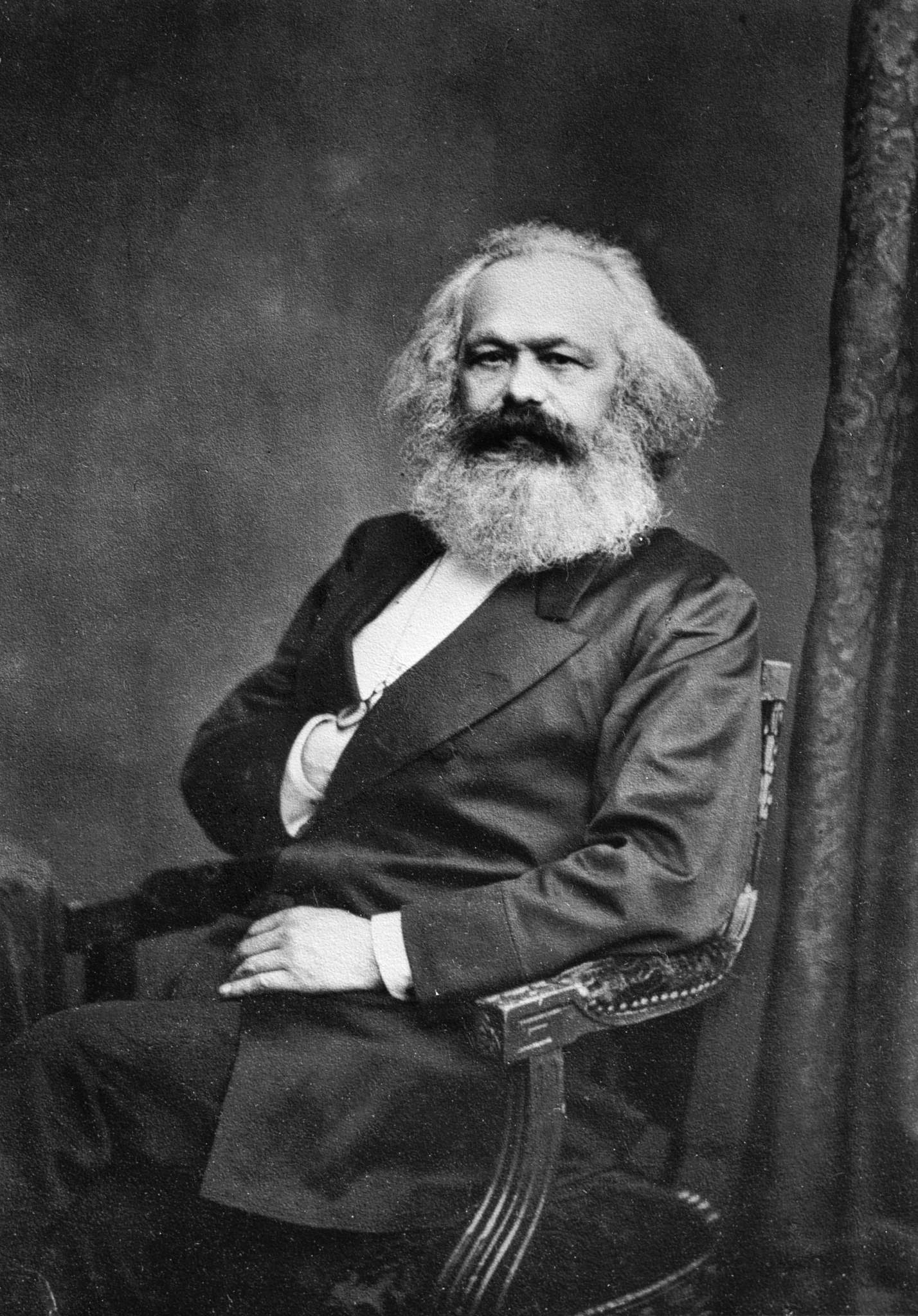

At risk of appearing provocative, this brings me to a certain fellow who has been mentioned surprisingly rarely during this latest crisis, certainly in comparison to past crises of a similar type: a chap you may have heard of by the name of Karl Marx.

Marx argued that the ‘true’ value of a product was generated by the labour put into its creation, but that this did not necessarily accord with the market value that the product could be sold for. By organizing well, by generating economies of scope and scale, by controlling a particular niche in the supply chain, a little bit of money could be shaved off the price of a product or a little bit extra charged for it: and as you sell more and more product, this little margin starts to add up to a lot of profit for the company doing the shaving.

The genius of the system, Marx believed, was that a big capitalist could skim a couple of pennies from each of his workers or cadge a couple extra from each of his customers, and none of them would likely notice the difference. Meanwhile, he’d end up with a fortune. (Bet you didn’t realise that Richard Pryor in the Superman movie was following in such a hallowed tradition of political economy!) In the Marxist model, the system was supposed to collapse when the competitive pressures to increase margins generated a class of overworked, alienated, revolutionary-minded proletarians who then took the big nobs out and strung them up from the lampposts.

Of course, Marx’s prediction didn’t turn out too well, and the people who claimed to be following in his name didn’t produce much of an alternative (to say the least!) Instead, democratic governments intervened in the economy in ways that sought to limit the most extreme inequalities produced through capitalist self-interest, effectively helping capitalists survive against their own self-destructive urges, you might say. We know these legacies as: unemployment insurance, health care, pensions, public education, and even central banks. So the revolution didn’t come.

Still, the question Marx's theory raises about identifying the 'true' value of a product or service continues to have a powerful resonance. After all, it was the breakdown of the link between 'real' values of houses (whatever they are) and their market prices that arguably got us into this mess. Moreover, the bonus culture is a perfect manifestation of the principle of surplus value raised to the nth degree. It’s been particularly pervasive, in my view, in the banking sector precisely because this is the most globalised part of the world economy and therefore arguably the bit that’s least subject to the restraints imposed by national governments, and the most free to the play of pure market forces.

All of which leads me to conclude that the only restraints on today’s international capitalists that are likely to be effective will be based on comprehensive, global agreements. Either that or it's lamppost time down at Goldman Sachs!

Alex Goodall

Papamoka’s European Contributor

From A Swift Blow to the Head

Labels: Bank Bonuses, karl marx

7 Comments:

I think I see your point Alex but I'm wondering if the Karl Marx thingy is relevent to the non stop pay for CEO's on Wall Street. If a bank wants taxpayer dollars to stay afloat then the taxpayers and our government has a right to put in guidelines for those institutions. I'm pretty sure all the forms they will have to fill out will put thousands of lawyers back at work alone for each institution taking the bailout.

I have to agree with Obama on the pay scale cap. You don't beg for money from the taxpayers and then hand yourself a bonus or huge pay raise.

Interesting and well thought out post bro!

With so many contributors writing for Straight Talk, it would be helpful to readers if there were bylines at the top of the posts as well as at the bottom. (Michael always greets bloggers at the beginning of his, so his are easy to spot.)

Each contributor has a unique writing style with which to make a point – serious and straight, tongue-in-cheek, irony, humor.

It wasn’t until I got to the English spelling “globalised,” that I realized Alex contributed this post and not Papamoka.

Individual writing styles aside, the reason this would be helpful is: the background of contributors – previous posts, occupation, location and so forth - often helps in interpreting meanings.

I will refrain from commenting on the current post and will go back and reread it for a better understanding.

Thanks to all Papamoka contributors!

BJ

Aha, I should have spotted the spelling of “labour” earlier in the post, LOL!

Excellent post, Alex. Karl Marx, as an economist, is very appropriately interjected into the equation. I kept getting bogged down, while reading, in the fact that so much of what he pointed out most assuredly is occurring in today’s economic forces. I am not an economist, having gotten no further than Economics 101, and probably have a better understanding of such forces as they relate to history.

In the interest of King Profit, there’s been a lot of “shaving” going on, both in product quality and in worker benefits (there’s no such thing, in my opinion, as “comp pay”), while prices continue upward.

In your honest opinion, do you think conditions could deteriorate to the point that capitalist societies could produce future revolutions?

Maybe with a cry of “workers and consumers of the world unite!”

You are right that Marx’s theories about capitalism fell flat and revolution didn’t come because of the “perks” you listed, but with the removal or cutting-back of all those perks and with sheer deprivation among a modern-day proletariat, could it happen again? Even in America?

After all, it happened once before in this country – at the time of its birth.

Globalization is a sensitive topic with the “buy America first” crowd, but I agree that we are players in a world market, and there will have to be some system of global regulation. (Think lead-painted toys and pirated copyrighted materials.)

Marx’s theories were a dismal failure in the Soviet Union, and capitalism remains the best there is to offer, if greed and excess don’t kill it.

BJ

Wow. Thanks for the comments, guys.

In (very quick) response:

Papamoka: I agree with what you're saying totally. The point I was making is that bonus culture is a wider problem than just for the "bailout" institutions. If we only think about it on an ad-hoc basis and only when the banks come begging for help, it means that when the banks no longer need the money, they'll just go back to the bad old ways. We need new laws, not informal instructions enforced by a threat to withhold money.

BJ (1): Thanks, you're right. I'll start by saying "Alex says" or something to identify my posts.

BJ (2): As a professional historian, my number one rule is to not make predications about the future - they're almost always guaranteed to be wrong!

That said, on this question of revolutions I think the mistake many people make is in thinking that revolutions happen because the people at the bottom get so dissatisfied that they can't take it any more. (This is how it's presented by Marx, for instance, in the example I cited.)

In reality, revolutions are almost always set off by conflicts amongst elites (even if people in the "lower" orders of society can sometimes take advantage of the crisis to their own benefit).

Also, even if it was possible for small groups to rise up and march around burning stuff in the eighteenth and nineteenth century, it's not really true anymore. Developed states are just too powerful for that; they'd just squish any revolutionary movement. That's why the revolutions of the twentieth century have always been on the "periphery", in the countries where state authority is not yet as absolute as it is in the "developed" world.

But whether a particular arrangement of circumstances could produce a division amongst elite groups, which could in turn end up in a cataclysm of some sort? Well, who knows! Certainly, the lesson of the past decade is that history never stops happening!

Perhaps this is basically a cyclical phenomenon? When the excesses of 19th-century capitalism grew too extreme, the state (and unions, don't forget) enforced a more equal distribution of resources and a social safety net as you describe -- for that matter, the smartest capitalists realized that this was in their own interests, to prevent things from getting so bad that it would end in revolution. Then time passes, people get complacent, the safety net is allowed to erode, those at the top manage to skim off more and more of the wealth for themselves -- and eventually society votes in a government which creates a new raft of redistributive measures and re-stabilizes the system.

Certainly Papamoka's right. If the banks take the money they have to take the rules that come with it. If these executives are such brilliant managers that they're worth these huge bonuses, how come the businesses they manage ended up in such a mess? Would you offer eight-figure salaries to hire the guys who got the banks into the state they're in now?

As for the threat of revolution, such talk is out of fashion these days. But if Congress passes a stimulus bill with the "buy American" provisions taken out, and unemployed steelworkers see their tax dollars being spent to import steel from other countries while their own jobs stay gone, then we will start hearing talk about lampposts again.

Developed states are just too powerful for that; they'd just squish any revolutionary movement.

The age of violent revolution in developed countries is probably over, not only because the state is too strong but because it's designed to co-opt discontent. Hypothetically, if the masses became overwhelmingly furious at the way things were and the government absolutely refused to take notice, radicals wouldn't seize power by riding a wave of mass violence -- they'd be voted into office instead. It's remotely possible that could happen in western Europe, where the political parties have converged on such a consensus that it's difficult to effect real change by working within mainstream politics, but in the US, we seem to be able to vote in more moderate change before things get to that point.

Thanks, Alex. How 'bout a byline at the top (by Alex)? Appreciate the answer. I think of revolution as "of the people" and a struggle among elites as a coup d'etat. BJ

Post a Comment

Subscribe to Post Comments [Atom]

<< Home